Travel insurance costs real money—and one vague exclusion can turn a bad day into a very expensive one. This best travel insurance for bikepacking guide shows you what to check (fast), so you can buy coverage that matches how you ride.

I once saw a bikepacker’s frame snap on a remote Patagonian trail—the bigger shock was learning his “comprehensive” policy wouldn’t pay because of vague wording and missing proof. Most bikepacking claim headaches come down to wording and proof. If you don’t know your gear value yet, skim our bikepacking gear guide.

In a hurry? Jump to the shortlist. Want the full outline? Jump to table of contents. Otherwise, use the tool below to set your coverage targets first.

This page contains paid/affiliate links. As an Amazon Associate we earn from qualifying purchases, and we may earn commissions from other partners—at no extra cost to you. Links marked with ‘#ad’ are affiliate links, meaning we may earn a commission at no extra cost to you. Learn more.

Bikepacking Insurance Fit Tool

Pick one option from each category to see tailored coverage targets for your bikepacking trip.

Trip length

Route remoteness

Total gear value

Your recommendation

Pick one option from each category to see tailored coverage targets for your trip.

💡 Tip: Start with route remoteness—evacuation needs often matter most.

Table of Contents

- Bikepacking Insurance Fit Tool

- Key Takeaways

- Claim-proof in 10 minutes

- Why Standard Travel Insurance Fails Cyclists

- What Bikepacking Insurance Won’t Cover: Common Exclusions

- Must-Have Coverage Types for Long-Distance Bikepacking

- Comparison of Bikepacking Travel Insurance Options

- Quick Shortlist: Insurance Options Bikepackers Actually Use

- My Evaluation Criteria for Bikepacking Insurance

- Alternative Protection Strategies

- Building Your Travel Insurance for Bike Touring Strategy

- Frequently Asked Questions

- Conclusion

Key Takeaways

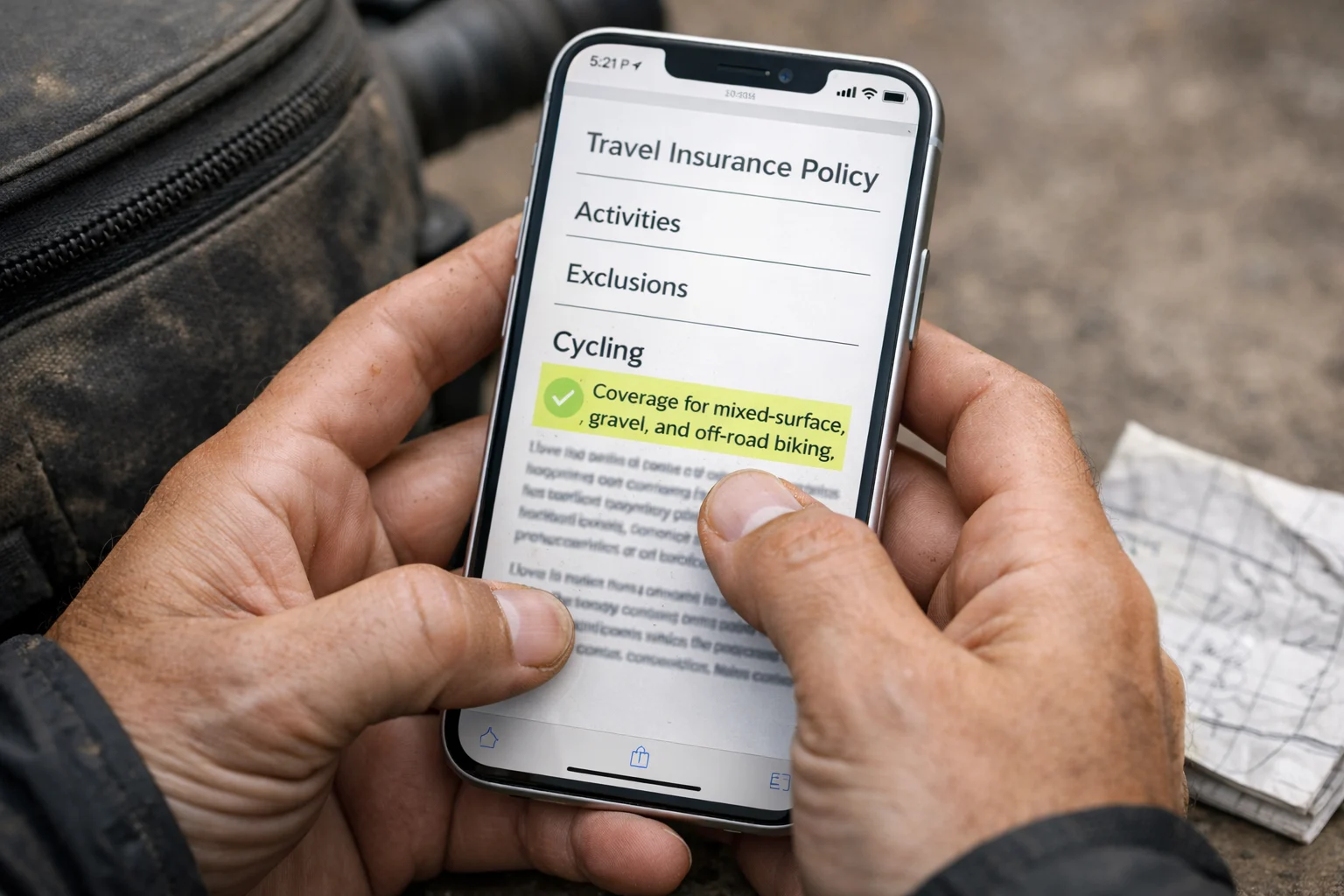

- Most “standard” plans don’t match bikepacking reality (activity definitions + mixed-surface riding).

- Gear coverage lives or dies on the single-item limit—especially for the bike itself.

- Remote routes make evacuation + 24/7 assistance the real anchor.

- Claims go smoother with proof: photos, serial numbers, receipts, and fast reporting.

- Two-policy setups (medical/evac + separate bike cover) can beat “one big policy” for high-value bikes.

Do this first (60 seconds): write down your bike value and the minimum single-item limit you’d need to replace it.

Coverage depends on how cycling and equipment are defined—confirm your riding style before you buy.

Claim-proof in 10 minutes (before you buy)

Bikepacking claims usually fail on proof, not drama. Do this once and you’ll shop smarter and file faster if something goes wrong:

- Photograph your bike from both sides + a close-up of the serial number

- Screenshot your top 3 receipts/order confirmations (bike + phone/GPS + one big-ticket item)

- Make one “gear inventory” note with rough values (one list is enough)

- Save the insurer’s 24/7 assistance number + claim steps in your notes (and offline if possible)

- Fast “reasonable precautions” proof: take one photo of your lock setup and where the bike/bags were stored (camp/hotel/garage)

Optional: 3 small items that make claims easier

These don’t make you “covered,” but they make proof and “reasonable care” rules easier to satisfy on the road:

Why now: if you can document fast (photos + receipts + timeline), you avoid most payout arguments.

Here are specific, highly-rated options that many bikepackers use to keep proof dry and organized:

YUMQUA Waterproof Document Bags (3-Pack) — receipts & passport stay readable when soaked

Clear front lets you see contents without opening. Secure waterproof seal keeps everything dry in heavy rain.

Pelican Marine Waterproof Phone Pouch — photograph damage in rain or river crossings

Fully touch-sensitive clear front + floats. Waterproof-rated design works with latest phones so you can document proof fast.

TICONN Zipper Tool Pouches (3-Pack Combo) — organize serial notes, receipts & small tools

Durable fabric, carabiner clip, reflective strips. Different sizes keep proof separate from wet gear.

Nice extra layer (optional): A hidden tracker for faster recovery

A tracker won’t replace insurance, but it helps with recovery and gives you a solid “last seen” timestamp + location trail for your claim timeline. Choose the one that matches your phone.

| Phone | Tracker | Why it helps | Link | Optional mount |

|---|---|---|---|---|

| iPhone | Apple AirTag | Seamless Find My network for location beyond Bluetooth. Start with one for the bike; a multi-pack is usually better value per tag if you can afford it—tag bike + main luggage bag + electronics pouch + spare tag. | View single on Amazon | Low-profile adhesive mount (water-resistant style) |

| Samsung Galaxy | Galaxy SmartTag2 | SmartThings Find network + long battery life. Start with one; a multi-pack is better value if tagging multiple items (bike + main bags). | View single on Amazon | Adhesive case (water-resistant style) |

Best spots to hide a tracker (choose 1–2):

- Steerer tube / headset cap stash

- Under saddle (inside saddle bag or under-seat mount)

- Inside handlebar end plug

- Inside frame bag (sewn or hidden inner pocket)

- Under bottle cage (behind cage or mount plate)

- Seatpost area (only if not easy to access)

- Tool can / pump compartment

Quick safety note: Use purpose-built mounts or stash caps—don’t wedge a loose tag somewhere that can rattle or interfere with steering/brakes.

Compatibility note for other Android phones:

SmartTag2 is designed for Samsung Galaxy phones via SmartThings Find. If you’re on a different Android phone (Pixel, OnePlus, Xiaomi, etc.), only buy a tracker if it explicitly supports Google’s Find My Device network on your device.

Why this matters: you’ll instantly see whether a policy’s single-item limit and theft rules can realistically replace your bike—and you’ll avoid buying coverage you can’t successfully claim on.

Why Standard Travel Insurance Fails Cyclists

Most travel insurance is built for “hotel + day tours.” Bikepacking is different: you’re riding loaded, on mixed surfaces, and sometimes far from towns—exactly where definitions get fuzzy. It’s the kind of surprise that can hit at 2 a.m. when you’re staring at a policy PDF on your phone, realizing a claim might hinge on what “off-road” means.

Plain-English note: when people search for bikepacking insurance, they usually mean a policy that (1) clearly covers cycling on the surfaces you ride and (2) has gear limits that can actually replace a bike.

The “Risky Activity” Trap 🚨

Many mainstream plans treat anything beyond casual city riding as higher risk. If you’re shopping for touring coverage, slow down here and read the exact cycling definition.

- Mountain biking may be excluded

- Unpaved touring can be classed as an adventure sport

- Multi-day riding can trigger “hazardous activity” clauses

- Remote riding can expose assistance and territory limits

Equipment Value Disconnect

Standard travel insurance often treats your bike like a suitcase. Here’s the reality gap:

| Your Gear Reality | Standard Policy Assumption |

|---|---|

| $3,000–$8,000+ bike | $500 maximum per “sports equipment” |

| $2,000+ in camping/cycling gear | $200–$500 total personal effects |

| GPS units, power banks, cameras | “Electronics” with minimal coverage |

| Custom/specialty components | No coverage for non-standard items |

Quick reality check: you can be “covered” on paper and still get a disappointing payout—so treat gear limits as a deal-breaker, not a detail.

What Bikepacking Insurance Won’t Cover: Common Exclusions

Exclusions derail tours because they’re predictable and easy to miss. Even good policies draw hard lines around wear-and-tear, pre-existing issues, and paperwork.

Mechanical Failures and Wear Items

Most policies won’t pay for normal wear. Some will pay when damage is clearly tied to a specific incident (and the policy includes accidental damage).

| Item / issue | Usually excluded | Sometimes covered if… |

|---|---|---|

| Chain, brake pads, tires | Wear and replacement | Damage is clearly caused by a crash/incident (and documented) |

| Cables, housing, bearings | Gradual degradation | A documented incident causes sudden breakage |

| Derailleur / hanger | Routine failure | Impact damage from a crash or transport mishandling |

| Wheel damage | Normal wear / maintenance | Crash/obstacle impact with photos + repair receipt |

| Frame cracks | Pre-existing / manufacturing issues | Clearly tied to a single event, with proof of condition before the trip |

Pre-Existing Conditions (Gear and Medical)

- Gear: known damage, previously repaired parts failing again, and worn components that break predictably.

- Medical: ongoing treatment needs or prior injuries (knees, back, wrists). Mental health coverage varies by provider.

Geographic and Activity Limitations

- Conflict zones and active government travel advisories

- Altitude limits on high-mountain routes

- Competitive events including organized races

- Guided vs. independent distinctions

- Trip duration caps if you’re traveling long-term

The Documentation Trap

This is the unglamorous truth: claims usually fail because proof is missing, not because the incident is “unbelievable.” Common denial triggers:

- ❌ No receipts / order confirmations for high-value items

- ❌ No serial numbers for bikes/electronics

- ❌ Missing theft report when it’s required

- ❌ Weak photos (or none) of damage and the scene

- ❌ Late reporting when the policy expects quick notification

Do this today: use the Claim-proof in 10 minutes checklist above and save it in one cloud folder you can access from your phone.

Must-Have Coverage Types for Long-Distance Bikepacking

No single policy covers everything. Think in modules: medical/evac + assistance first, then gear rules, then interruption and liability.

Medical and Emergency Evacuation 🚁

Why it matters: on remote routes, the cost and coordination of care can escalate quickly. The best plans don’t just reimburse—they guide you through the steps when you’re stressed and far from home.

- Emergency evacuation coverage that fits your remoteness

- 24/7 assistance that can coordinate care

- Clear cycling inclusion for the terrain you ride

- Repatriation if you need to return home for care

The CDC has a practical overview of travel insurance (including medical evacuation): CDC travel insurance guidance.

Equipment and Gear Protection

Gear coverage is rarely “all or nothing.” The limit that bites most bikepackers is the single-item limit (for the bike), plus the theft rules and documentation expectations.

If you want gear protection that actually helps, check how the policy classifies bicycles (personal effects vs. sports equipment) and whether the single-item limit can replace your bike.

Quick decision rule (high-value bike):

If your bike’s value is higher than the policy’s single-item limit, consider a two-policy setup: (1) travel medical + evacuation/assistance, plus (2) separate bike/gear cover that can actually replace the bike.

If the insurer won’t confirm key wording in writing, treat it as “not covered.”

Trip Interruption and Delay

Interruption coverage matters when you can’t ride but still need to keep moving: extra nights, alternate transport, or getting to a safer place while your bike is repaired.

Personal Liability Protection

Liability can help if you damage property or injure someone, and it may cover legal defense costs in some cases.

Which coverage level fits you?

Short trip + towns + modest gear: prioritize medical + basic theft/damage; gear cover can be lower if your bike isn’t a big-ticket item.

1–3 months + mixed surfaces: you’ll want clearer cycling wording, stronger interruption, and a realistic single-item limit.

Remote routes: treat evacuation + 24/7 assistance as the anchor, then build gear coverage on top.

Do this next: save the insurer’s assistance number in your phone and write one line: “If I crash remote, who coordinates care?”

Comparison of Bikepacking Travel Insurance Options

If you’re trying to pick the best travel insurance for bikepacking, don’t start with brand names. Start with your route (remoteness), trip length, and the bike’s single-item limit problem. Most riders land in one of these setups.

If you see providers describing themselves as adventure cycling insurance, treat that as a starting signal—not proof. You still need the exact cycling definition and the gear limits in writing.

| Coverage route | Why bikepackers use it | Main watch-out |

|---|---|---|

| Adventure-focused travel insurance | Often clearer activity language + better fit for remote routes | Documentation can be stricter; item limits still matter |

| Mainstream travel insurance + add-on | Can be cheaper; easy to buy in many countries | Cycling may be excluded unless the add-on is the right one |

| Travel medical/evac + separate bike/gear cover | Works when your bike value blows past single-item limits | You’re managing two policies (and two claim processes) |

| Evac membership (supplement) | Strong option for remote extraction + coordination | Not a full replacement for medical/gear cover |

Shortcut: remote route → prioritize evacuation + 24/7 assistance. High-value bike → prioritize the single-item limit (or a two-policy setup).

Quick Shortlist: Insurance Options Bikepackers Actually Use

These are examples bikepackers commonly research. I’m not ranking these—just showing common options riders compare. Availability and terms change, so treat this as a starting point—then verify the exact cycling definition, item limits, and trip duration rules before you pay.

- World Nomads (Standard/Explorer plans)

- Best for: adventure-style trips where you want clear activity guidance as a starting point.

- Ask/verify: your exact riding type (loaded touring, gravel, unpaved roads) and any “off-road” wording.

- Watch out for: equipment limits (especially the single-item cap) and proof requirements for theft/damage.

- True Traveller (activity packs)

- Best for: riders who like the clarity of selecting an activity tier/pack.

- Ask/verify: which activity pack explicitly matches your terrain + touring style.

- Watch out for: mismatch between “cycling” vs “mountain biking” vs “off-road” definitions.

- SafetyWing (Nomad Insurance)

- Best for: long-term travelers who prioritize medical-style coverage and ongoing trips.

- Ask/verify: whether your riding is included by default or needs an add-on; how gear is treated (luggage vs equipment).

- Watch out for: gear/bike caps being lower than you expect; confirm claim steps work while traveling.

- Global Rescue (membership add-on)

- Best for: remote routes where extraction/coordination is the real risk (supplement layer).

- Ask/verify: what’s included (evac/extraction logistics) vs what is not (medical/gear insurance).

- Watch out for: treating membership as a replacement for travel medical/insurance—it’s usually not.

| Option (example) | Best for | Check cycling wording | Check gear/bike limits | Good “fit” signal |

|---|---|---|---|---|

| Adventure travel insurer | Mixed terrain tours, flexible itineraries | Does it cover loaded touring on unpaved roads? | Single-item limit for a bicycle; theft-from-campsite rules | Clear activity list + clear claim steps |

| Activity-pack insurer | Trips where you choose an activity tier | Which pack covers your riding type? | How bikes are categorized; item caps | Tier language matches your route |

| Travel medical subscription | Long trips where medical is priority | Is cycling normal activity or add-on? | Gear terms and caps | Medical coverage is simple and continuous |

| Evac membership | Remote extraction + coordination support | Not the focus—this is logistics | Doesn’t replace gear cover | Remote route + limited local rescue options |

My Evaluation Criteria for Bikepacking Insurance

I use a simple scorecard because bikepacking claims usually fail on wording and proof—not on “how nice the website looks.”

- Coverage fit: cycling definition matches your terrain; evacuation/assistance matches your remoteness; gear limits are realistic.

- Claim reality: you can actually do the steps while traveling (photos, reports, timing, support).

- Cost & friction: deductible you can stomach; clear reimbursement process; predictable proof requirements.

Ask these questions (and get answers in writing)

- Equipment: “If my bike is stolen from my tent at a campground, what proof do you require?”

- Equipment: “What is the single-item limit for a bicycle, and can it be increased?”

- Equipment: “Are aftermarket/custom components covered at full replacement cost?”

- Medical/evac: “If I crash on a remote trail and need evacuation, who coordinates rescue and who pays providers?”

- Medical/evac: “Does coverage include cycling on unpaved roads and multi-day touring routes?”

- Claims: “Can I submit claims fully online with photos if I’m traveling?”

- Claims: “What’s the reporting deadline for theft/damage, and what happens if I’m offline?”

Copy/paste template: get the answer in writing

Use this as an email or support chat message (short is better—your goal is a clear “yes” you can save):

Hi — I’m planning a multi-day bikepacking trip.

1) Can you confirm this policy covers loaded cycle touring on mixed surfaces (including unpaved/gravel roads), not just “recreational cycling”?

2) What is the single-item limit that would apply to a bicycle, and how is the bike categorized (personal effects vs sports equipment)?

3) If my bike is stolen from a campsite/hotel, what proof do you require (receipt, serial photo, police report, lock requirement, time window)?

4) For a remote crash: who coordinates evacuation, and do you pay providers directly or reimburse later?

Please reply confirming the above in writing. Thanks.

Deductibles, claim windows, and “who pays first”

Picture yourself at a clinic desk or repair counter. What matters is what you pay now and what you can recover later.

- Deductible/excess: what you pay per claim (and whether gear claims differ).

- Claim deadline: when you must notify, and what counts as notification.

- Coordination: whether assistance helps you arrange care, not just reimburse afterward.

Alternative Protection Strategies

Insurance is one layer. Smart bikepackers also reduce risk so insurance becomes a backstop—not the plan.

Gear-risk reduction

- Split high-value items across bags (don’t put everything in one “steal me” pouch).

- Carry the small spares that end tours: derailleur hanger, brake pads, a spare chain link.

Financial backstop

- Keep an emergency buffer for gaps insurance won’t cover (wear items, minor repairs, fast replacements).

- Carry at least two payment methods and a small cash buffer.

Building Your Travel Insurance for Bike Touring Strategy

Here’s the simplest way to build coverage that matches your tour—without overbuying.

Step 1: Profile your trip

- Duration: weekend vs. months changes everything.

- Remoteness: the biggest driver of evacuation/assistance needs.

- Surface mix: paved touring vs. mixed terrain affects “activity” wording.

- Gear value: the single-item limit can quietly make bike coverage meaningless.

Step 2: Find the deal-breakers

- Activity exclusions (off-road, “hazardous,” “mountain biking,” undefined “trail riding”).

- Single-item limits for a bicycle and how “sports equipment” is defined.

- Trip duration caps if you’re going long.

Step 3: Choose your coverage route

- Remote route? prioritize evacuation + 24/7 assistance first.

- High-value bike? prioritize single-item limits (or separate bike/gear cover).

- Long trip? prioritize extension flexibility and claim logistics.

Do this last: use the Bikepacking Insurance Fit Tool above and screenshot your result—then compare policies against that checklist, not the marketing page.

Frequently Asked Questions

Conclusion

“Best” doesn’t mean “most expensive”—it means coverage you can actually use when something goes wrong. Start with the big drivers (remoteness, trip length, and the bike’s single-item limit), then buy the policy whose wording and claim steps you can follow from the road.

This guide is general education, not personalized insurance or medical advice. Policies vary widely by provider, residence, and trip details—so your coverage and outcomes may differ. For your situation, review the policy wording carefully and consider speaking with a licensed insurance professional or qualified advisor before you buy.